Rising unemployment, a slowing real estate market, and global inflation burned a $140 million hole in Seattle’s budget, and future shortfalls look likely. Even if those don't materialize, the status quo is nowhere near enough to tackle our cluster of crises: homelessness, inequality, climate change, behavioral health, and road violence.

We can fix this, but we’ve messed it up before. During the Great Recession, local governments slashed spending on everything from housing to parks and mental health services to library hours. We still live with the consequences, on our streets and in our neighborhoods, every day.

But this time, instead of cutting desperately needed services, let’s expand and diversify our revenue streams and make them progressive.

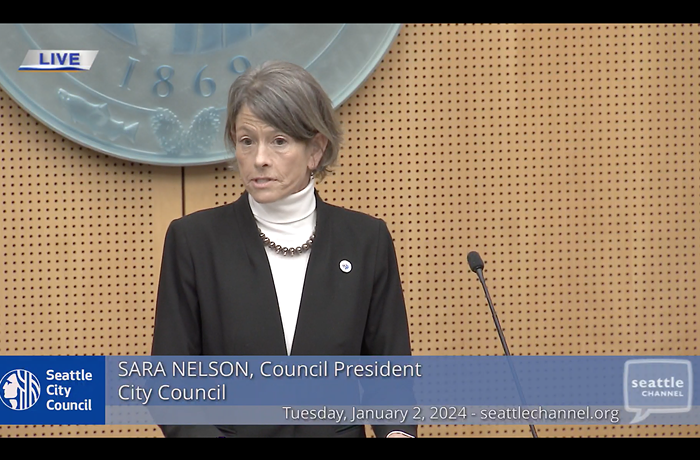

To that end, Seattle City Council Budget Chair Teresa Mosqueda has convened a progressive revenue task force with the Mayor’s office, representing an array of Seattle’s political constituencies. That’s great, but we don’t need to wait for recommendations before we act on what the city needs. And yet, many on the council seem to lack urgency, with six of the nine members voting to reject a recent proposed expansion to JumpStart. That’s inexcusable.

Though the State Legislature has made it tough for cities and counties to raise revenue, we do have options if we think creatively.

Some Criteria

As someone who ran a startup, I learned there is a lot to consider when building complimentary revenue streams. Also, not all progressive taxes are created equal, so we need to establish some criteria to determine viability.

First, model how much money a tax raises minus the amount of money it takes to administer. Also, consider how progressive it is. The more it redistributes from the rich to poor, the better. The best revenue is also resilient during economic swings and doesn't swing up and down with its companion sources.

Next, consider legal risk. How likely is a court to strike it down? Alternatively, is this a promising avenue for the courts to create carve outs that open up options for new kinds of progressive taxes? Similarly, look to political consequences; does the tax have staying power? Is it likely to build momentum for a progressive majority or provoke backlash? Finally, avoid other negative consequences, like Council Member Alex Pedersen’s “100% low income” sixplex plan, which would mean no new units, low income or not.

Let’s Start With These

- Expand JumpStart. It’s legal, and it’s nothing like the Trotskyist attack on business that the anti-taxxers pretended in their propaganda. It’s a small correction to an 80-year low in fees for high incomes and corporations. An increase like the recent proposal during the budget season plus an additional tier for incomes over $1 million will leave the region plenty competitive.

- Tax parking, with higher rates for open-air lots and those in transit-rich areas. Increase the fees for street parking. Use the same pattern to charge impact fees on new spots. For both, exempt disabled parking and residential street parking for folks in poor census tracts, or those who qualify for government assistance.

Seattle has 1.6 million spaces. Parking increases driving, pollution, and road violence. It raises development costs and makes it tough to build compact, complete neighborhoods. If we also eliminate parking minimums, we will raise revenue, increase housing options, and significantly improve quality of life. - Enact an empty homes tax, as in Vancouver. This may not open tons of homes or raise tons of money. But we desperately need both, and it will do some of each.

- Last, levy a 1% income tax. To make it progressive, pair it with either a standard deduction (1% x (income-$40,000). Or, to make it even more progressive, pair it with a cash rebate (1% x (income) - $400), since the poor would receive a check instead of a tax bill.

Seattle voters support an income tax, and it’s time to take the fight to the state Supreme Court. Make the deduction/rebate severable so that a flat income tax becomes the worst case scenario in the advent of a cranky court. Such a tax would still be much more progressive than our sales and property taxes.

And That's Not All

My top runners-up are promising, but they need more analysis. I’m a huge fan of the progressive consumption tax; it’s wonky and weird, but it’s wickedly cool. Shoehorning it into state law will require some serious finesse, so it merits more serious study.

We could also auction off air rights for development, as in Sao Paulo, but we’d have to identify how this would interact with the city’s Mandatory Housing Affordability (MHA) program. Or we could consider a more groundbreaking infrastructure efficiency fee, based on the net revenue associated with different property types. Urban3’s work suggests this would be progressive, but it is novel enough that we’d need serious expert advice on how to do it.

There are a host of other options, too. We could charge for excessive pay inequality in companies, or even the use of bridges with exemptions for people in poverty. We could increase capital gains or estate taxes, or add an inheritance tax. We could increase MHA fees or real estate excise taxes, particularly on luxury property, or add additional charges for AirBNBs.

Whichever taxes they pick, the council needs to get moving. The alternative is huge cuts that will erode our quality of life, undermine local businesses, and make life worse for our most vulnerable neighbors. It will leave all our crises to fester. We tried that path in the Great Recession. It failed. It’s time for something better.

Ron Davis is an entrepreneur that has spent most of his professional life working to improve the lives of workers and seniors. He's a on the boards of Futurewise, Seattle Subway, the Roosevelt Neighborhood association and the University YMCA, where he fights to make Seattle a more just, inclusive, green, walkable, city. He has a JD from Harvard Law School and lives in Northeast Seattle with his wife, a family physician, and their two boys.