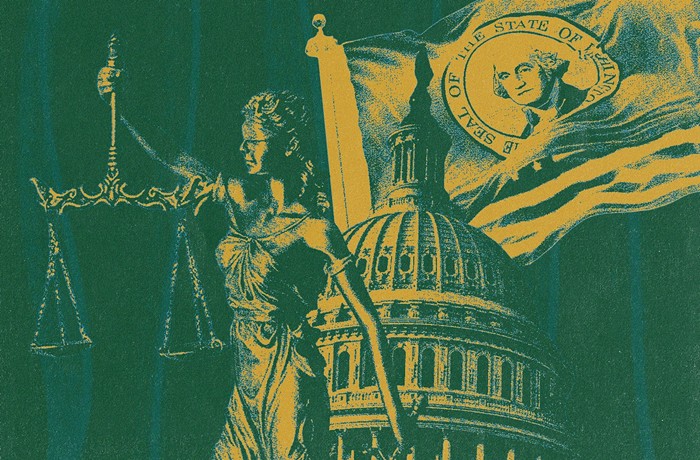

This is part one of a five-part series on rent control in Washington state.

Rhoda Mueller was paying $1,050 a month to rent a small, two-bedroom house in Edmonds. Then one day last February, out of the blue, her landlord hiked her rent $600—a staggering 57% increase.

She tried to bargain, offering to pay $200 or $300 more a month. After all, she and her family of three had a good relationship with the landlord. Her partner, a professional landscaper, manicured the house’s “elaborately landscaped” yard and took care of maintenance issues himself. They passed yearly inspections with flying colors, Mueller says.

But the landlord wouldn’t budge. According to Mueller, he’d recently joined a landlord’s association, where he was told he should charge more for rent. And so he did.

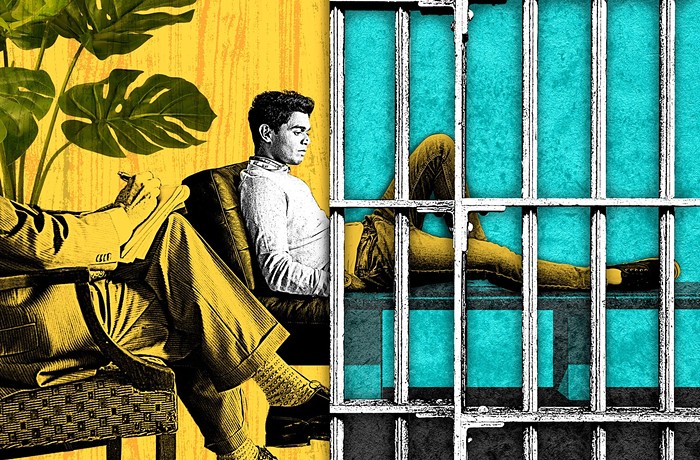

Mueller, 49, has limited mobility and doesn’t work. She spends her time taking care of her 31-year-old son, who struggles with schizophrenia and heart problems. Relocating would be a pain, but the $600 hike meant they’d be spending over half their income in rent, which was untenable.

Mueller wanted to stay close to family doctors while also limiting her partner’s commute to 45 minutes each way. But, in this market, the only place she could afford was a one-bedroom apartment in Lynnwood. So now she, her son, and her partner share a 670 square foot space with no yard, and no place to install a heated therapy pool she needs to stay healthy.

“It’s awful,” Mueller said over the phone. “I don’t know how to say that any other way. I wish we were back in the old place so much.”

Multiply Mueller’s story by about 53,000, which is the estimated number of households in the Seattle metro area (Seattle, Bellevue, Tacoma) who pay over half of their income in rent, and you’ll get a sense of how severe the affordability crisis has become.

Over half of Seattle’s households are renters, and “rents have soared 69 percent across Greater Seattle since 2010, more than double the national average of 32 percent,” according to an analysis from the Seattle Times. Across King County, rents have gone up 155% over two decades, growing “even faster than home prices locally.”

Though rent increases have been lower on average the last couple years, they're not going to become affordable any time soon. As the Times explains, in the last 20 years rents have only dropped 5% for about two years on two occasions—once after the burst of the dot-com bubble and once during the Great Recession—before jumping back up again.

If wages were keeping up with rent hikes, housing affordability wouldn’t be such a dire issue. But real wages (i.e. wages minus the cost of living) have fallen 3% over the last six years, and analysts predict they’ll continue to fall for the foreseeable future.

Paying the rent will only get harder for Washington's estimated 1 million renter households, and it’s already too hard. The National Low Income Housing Coalition lists Washington as the 7th most expensive state for two-bedroom apartments in the country, up from 8th place last year. It’s bad even for single people. Just to “afford” a studio apartment in Seattle, you need to make over $56,000 per year.

It’s no wonder that nearly half of Seattle-area renters pay more than they can afford in rent, with over 57,300 Seattle-area households giving more than 30% of their paycheck to their landlords, and around 53,000 giving more than half of their paychecks to their landlords. Those numbers represent a 31% increase in “cost-burdened" renters since 2000, according to the National Equity Atlas (NEA).

Living in a city where so many people are overpaying for housing not only sucks, it’s bad for the local economy. If Seattle renters were paying only what they could afford, the NEA points out, they’d have $6,800 more in their pocket every year to spend on literally anything else—food, child care, health care, transportation, education, $14 cocktails, a plane home for Christmas, little tchotchkes you get at that little tchotchke place that makes the neighborhood feel so special, or to bulk up savings for a downpayment on a house.

But for now, all of that money, and all the labor that goes into creating it, is currently padding the retirement funds of “Mom and Pop" landlords, (or legitimately serving as their sole source of income), or stabilizing returns on investments from giant corporations.

Anyone who has taken a walk through the Central District lately—and anyone who knows even one artist—can also tell you high rents have led to displacement. Over the last decade, large numbers of people of color in Central Seattle, North Beacon Hill, and Columbia City have been pushed out of their homes.

And before people get pushed out, the instability torments them, especially those with families. “Caregivers of young children in low-income unstable housing are subjected to significant negative health effects, becoming two times more likely than those in stable housing to be in fair or poor health, and almost three times more likely to report depressive symptoms,” according to CityLab’s review of a study on health and housing insecurity.

As they depress and immiserate large populations of renters, high rents also contribute to the homelessness crisis. In the last point-in-time count, 8% of respondents said a rent increase put them on the street. Moreover, Zillow found that a 5% rent increase across the city “would add 258 people to the homeless population.”

Displacement changes the culture of the city. It echoes the racist redlining practices that prevented black and brown people from building wealth, pushing people of color away from hospitals and preferred schools, and ripping up long-established social networks. As tenants leave the city for hopefully cheaper housing in the 'burbs, they face longer commutes and contribute to sprawl, which exacerbates climate change.

If governments and the magical hand of the market were producing enough homes for people of all incomes to inhabit, of course, none of this would be that big of a deal. Low-income renters would simply move into the cheaper apartments recently vacated by the upwardly mobile. But we all know that isn’t happening, either. In 2018, the Regional Affordable Housing Task Force determined King County needs to build 244,000 units of affordable housing in 20 years—and 156,000 of those units yesterday—or else we’ll all be living in one-bedroom apartments with our adult sons, if we’re lucky. Right now, King County's goal is to "build or preserve 44,000 homes for people making 50% of the area median income or less by 2024," reports the Times.

To sum up: the rent’s too damn high, it’s going to stay too damn high, and governments and private developers aren’t building enough housing to meet the astounding need for cheaper places to live for people.

To begin to address this affordability crisis, tenants and tenants rights organizations in California, Oregon, New York, and right here in sunny Seattle have built movements to rein in the rent. In September, Seattle City Council Member Kshama Sawant introduced her long-awaited rent control bill “free of corporate loopholes,” as she likes to say. If implemented, it’d be the strongest rent control in the country.

Capping rents, the argument goes, prevents landlords from evicting tenants by raising the rent so high they can’t pay, and it gives renters the stability they need to plan their future. If tenants know rents can only rise a certain amount, then they’ll be able to budget, set goals, and move out or stay on their terms. The other bonus is timing. Unlike building hundreds of thousands of units of housing, establishing a rent cap can be accomplished at the stroke of a pen. That pen, however, rests in the governor's mansion. Washington banned rent controls in 1981.

Movements to implement such measures have been met with fierce and well-financed opposition, plus withering critiques from free-market economists and market urbanists. Those critiques are strong and compelling, and some, quite frankly, freak me the fuck out.

In tomorrow’s installment of this five-part series on rent control, I’ll run through the case against rent control. After that, I’ll tell you why California and Oregon passed statewide “rent control” in spite of the case against it, and explain how grassroots organizers and progressive politicians overcame over-the-top opposition. In the final two installments, I’ll lay out the state of play on the local and state levels, and sketch out what needs to happen to stop landlords from rent gouging in Washington state.