Senator Patty Murray spent much of her reelection campaign fending off accusations from her latest Republican opponent that she somehow bears responsibility for the perceived uptick in crime across Washington state. While those allegations were both dumb and ineffective, Murray and her fellow Senate Democrats could actually take a significant step to preventing some violent crime in the next couple of weeks by passing the SAFE Banking Act.

The bill, which Democrats passed out of the House of Representatives earlier this year, would grant cannabis businesses in states with legal weed markets access to federally-regulated banks and end their reliance on cash transactions. With Republicans poised to take control of the House next year, and unlikely to engage on any Democratic policy proposals, Senate Democrats must act to pass the bill in the next few weeks before the lame-duck session expires.

If they don't, they're giving up on their last chance to remove the juicy target of piles of cash from the nation's dispensaries for at least the next two years.

How Reforming Weed Banking Laws Could Reduce Crime

Federal prohibition of cannabis creates all sorts of issues for both workers and pot shop owners in states with legal markets, but most of those inconveniences trace back to the fact that federally-regulated banks won't touch their money. As a result, dispensaries can't accept credit or debit cards and instead have to solely rely on cash transactions—which creates danger for customers and workers alike.

Unsurprisingly, the possibility of mountains of cash sitting around at a dispensary at any given time has put cannabis businesses (and their workers) at increased risk for armed robberies. While retailers have exaggerated the scale of the threat that so-called "organized retail theft" presents nationally, and some local corporations, like Starbucks, have ulterior motives for raising the alarm about security concerns in their stores, the threat to weed shops appears legit.

Aaron Pickus, a spokesperson for the Washington CannaBusiness Association, says pot shop owners have done all they can to mitigate the risk of having lots of cash on hand without Congress stepping in to fix the core issue. In an interview, Pickus said dispensaries have done everything from hiring armed security to adjusting the frequency of when and how often they transport cash to local credit unions that handle their day-to-day banking, but the strategies haven't made the industry less of a target.

In fact, according to the CannaBusiness Association, thefts targeted at dispensaries have increased sharply this year. Pickus shared an informal tracker that local dispensary owners have kept of robberies at their stores dating back to 2017, which showed that nearly half of the alleged thefts the industry has tracked occurred in 2022.

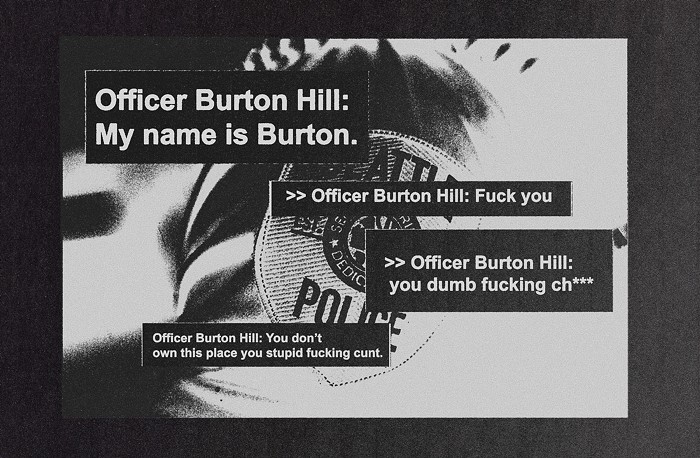

Zion Grae-El, an employee at Have a Heart's downtown Seattle dispensary, echoed Pickus's argument that the continued reliance on cash-only transactions puts workers like him at an increased risk of harm while at work.

Grae-El said in an interview that although he feels safe in his downtown store, the latest trend of robberies has made him worried for the safety of his coworkers at other locations that experience less foot traffic and have fewer surveillance cameras to discourage would-be thieves. He also noted that the latest surge in robberies involved even more dangerous tactics than a typical stick-up, with some stores seeing people use their vehicles like battering rams to overcome security.

Grae-El, a veteran of the US Army, said there are ways stores can protect their workers against those threats without relying on private armed security, but the simplest solution would be to remove the tempting target their reliance on cash-only transactions presents in the first place. If that problem was solved, Grae-El said dispensaries wouldn't need to invest in things like double security doors or concrete barriers in front of their store windows to protect their employees and customers.

So, Will the Senate Get Its Shit Together?

No one can say for sure, but it certainly seems like the Senate might actually fuck around and pass some good policy before the new year. Prior negotiations over the SAFE Banking Act had stalled due to some concerns from progressives that the House version of the bill didn't go far enough to address racism in the lending industry, but the threat of Republican hobgoblins taking control of the House in a few weeks seems to be pushing lawmakers toward a compromise.

Washington state Treasurer Mike Pellicciotti has been working to get red-state treasurers with emerging legal weed markets to lobby their Senators in favor of the bill. He said in a statement that he feels "optimistic" about the chances of getting the legislation across the finish line during the lame-duck session due to how many Republican state officials have responded positively to his outreach.

Pickus and Grae-El both noted that they've received positive signals from Washington's Congressional leaders as well. Pickus said industry advocates met with both Senator Patty Murray and Senator Maria Cantwell earlier this fall and left feeling positive about the prospects of the bill passing this year. More recently, Grae-El said he had a productive conversation with Congressman Adam Smith while Smith toured his dispensary about including the bill in the must-pass National Defense Authorization Act as one vehicle to get the legislation enacted before January.

Senator Murray's office confirmed in a statement that passing the SAFE Banking Act is "absolutely" among the Senator's priorities for the lame-duck session, but offered few details about how they'd get that done. Senator Cantwell's office did not respond to a request for comment, but I'll update this post if I hear back.

If you'd like to tell Washington's Senators yourself that you'd appreciate them doing the bare minimum to make it less likely that you or your friendly neighborhood budtender gets shot while picking up your next batch of edibles, you can find contact information for their offices here. They only have a few weeks to act and lots of other issues competing for their attention, so this is one of those rare moments when picking up the phone and calling your elected officials could actually make a difference.