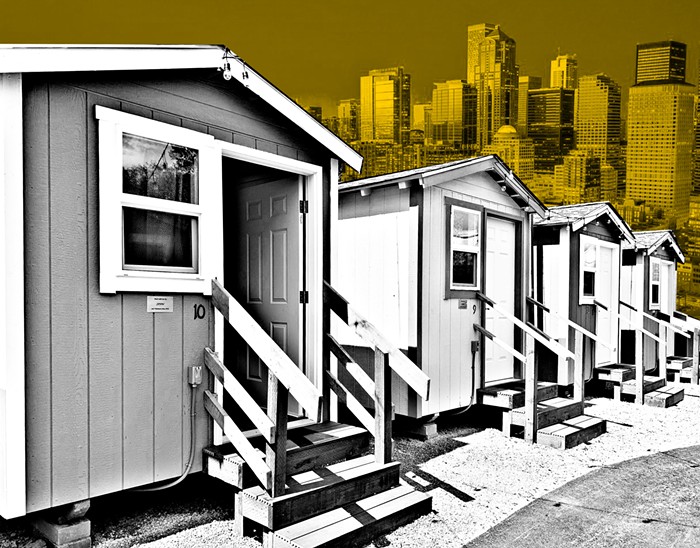

On Wednesday, the Seattle City Council met in a special committee to discuss the upcoming seven-year Seattle Housing Levy renewal for the first time since the Mayor proposed a plan to triple the levy voters passed in 2016. To set the stage before the council discusses and edits the Mayor’s nearly $1 billion proposal on April 19, the Seattle Office of Housing (OH) gave a presentation on the City’s current housing needs and the results of past levies.

Council Member Alex Pedersen noted in the meeting that the levy’s price tag may elicit “sticker shock” for home-owning constituents. However it's clear from the meeting’s presentation that Seattle needs all that money and then some to address the housing crisis.

The OH gave it to the council straight: We don’t have enough places for people to live. According to the presentation, developers only built one new unit of housing for every 2.6 new jobs in Seattle during the recent tech boom. With an increased demand, landlords have raised Seattle rents 45% from 2010 to 2021, pricing the average one-bedroom apartment at $1,900. That means you must make more than $76,000 per year for the cost of an average one-bedroom apartment not to “burden” you; that is, cost you more than 30% of your income.

In order to address the growing need, the OH said Seattle needs 112,000 new units of housing by 2044. That includes more than 70,726 new units needed for people who make less than 80% the area median income.

That’s a low-ball estimate compared to others. In a recent report, Challenge Seattle and Boston Consulting Group estimated that Seattle needs 120,000 new units today to meet the city’s needs and 82,000 more every year to keep up with its growth.

The Housing Levy won’t fund enough housing to cover either of those needs. The Mayor’s $970 million would pay for more than 3,000 units of affordable housing, $51 million in homeownership assistance programs, and $30 million in eviction prevention.

Some homeowners complained to KOMO about the proposed tax increase, which would cost the owner of a median-priced, $866,000 home about $380 a year. Plus, Seattle would not get triple the amount of additional housing despite triple the revenue, which is a disappointing reality of inflation.

But even if the proposed levy doesn’t solve the housing crisis on its own, OH showed the 2016 levy delivered and exceeded expectations. According to the OH’s report, the 2016 levy paid for 2,741 new affordable units and preserved 530 existing ones. Those results exceeded OH’s goal by almost 600 more new units and almost 200 preserved units.

Levy dollars can stretch further than anticipated because the funds often leverage more investment from public and private sources, such as the Washington State Housing Trust Fund and federal Low Income Housing Tax Credits, said OH spokesperson Stephanie Velasco. On average, she added, “every local dollar invested from the 2016 Seattle Housing Levy has been matched by over $3.50 of other public and private investment.”

The OH probably doesn’t have to defend the levy too hard against KOMO readers ahead of the vote this November. The housing levy typically passes without a hitch, even when the City jacks it up. For example, in 2016, the proposed levy came out to double the amount last approved in 2009 and 71% of voters went for it.

Plus, other than Pedersen’s comment about sticker shock, no one indicated any pushback from the council to the Mayor’s proposal. We’ll see if the #OneSeattle vibes continue in their next meeting.