In a 7-2 decision released Friday morning, the Washington State Supreme Court upheld the Washington State Legislature's 2021 capital gains tax, which taxes stock profits over $250,000 at a measly 7% to raise an estimated $500 million per year for early education programs.

After the news broke, conservatives around Washington and their friends in television news broadcasting started ringing the alarm about the potential for this tax to magically morph into a progressive income tax, which would still be illegal under the state constitution thanks to an old 1930s precedent that treats income as property. Unfortunately, the alarm conservatives are ringing is false. By the sounds of it, state Democrats never even heard of an income tax.

That said, the Court's decision does keep that dream alive.

Over the phone, University of Washington law professor Hugh Spitzer, who filed a brief with the Court in defense of the capital gains tax, argued that a majority of the justices would likely overturn that old 1930s precedent and uphold an income tax if the Legislature or the people (via an initiative) enacted one. "But I think the Court is reluctant to assume the role of policymaker," he said.

Back in 2017, Seattle tested those waters when it passed a 2.25% income tax on the wealthy. Rather than take the bait, the Supreme Court simply declined to hear the case after the state's Court of Appeals ruled that Seattle had the authority to pass an income tax with exemptions but not exceed the state constitution's 1% limit on property tax rates.

Though the Court gave Seattle the cold shoulder, Spitzer thinks that a law from the Legislature or a successful statewide initiative would carry more weight and prompt the justices to take up the case.

But don't expect anyone to move on any of that any time soon.

On a virtual press call Friday morning, Sen. June Robinson (who writes the Senate's operating budget and who carried the capital gains tax through that chamber in 2021) and Rep. April Berg (who chairs the House Finance committee) remained silent when I asked if there was any appetite in the Legislature to pass an actual income tax. Governor Jay Inslee dismissed the idea as a "Republican talking point" and said "it's not going to happen."

So for Democrats, or at least for Inslee, an actual income tax only exists as a Republican "boogeyman." It’s not a real proposal supported by real people who will continue to struggle under the weight of this unfair tax code until Democrats pass transformational tax reform.

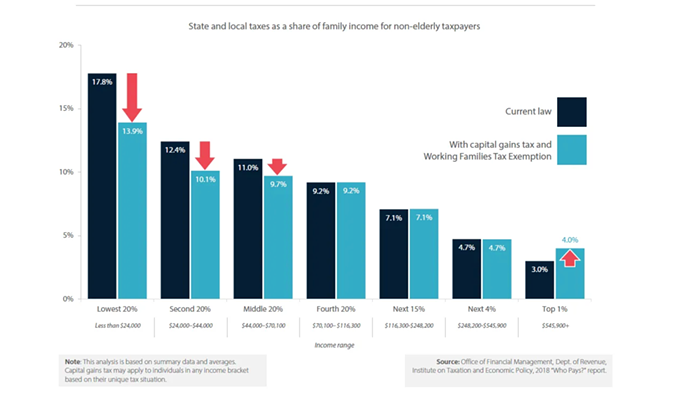

I'm not saying the capital gains tax isn't real reform. According to an analysis from the Governor's office, that tax, in conjunction with a tax rebate for the state's poorest households, will adjust the weight of the state's tax load a little bit:

Instead of living in a state where the richest pay 3% of their income in state and local taxes while the poorest pay 18% of their income in taxes, we'll become a state where the richest pay 4% of their income in taxes while the poorest pay 14%. Meaningful, but not transformational.

The fact that no politician on that press call chimed in to support even the abstract notion of an income tax shows just how much Democrats let Republicans control political narratives despite their large and enduring majorities in state chambers. That said, it's also pretty convenient for them: Dems love big business, and big business would revolt if state leaders actually did something to threaten their perceived competitive advantage with San Francisco or whatever.

Now, don't get me wrong. Democrats, operatives, activists, parents, kids, businesses who rely on the state to subsidize child care enough so that both parents can work, and those of us who generally don't want to live in a hell world rightfully celebrated this big win, which has taken more than a decade to secure thanks largely to Republicans, conservative Democrats in the Senate, and business interests blocking it every step of the way. The amount of coalition-building and door-knocking and waiting around for certain lawmakers to retire that people needed to endure just to tax 7,000 wealthy people is truly impressive and mind-blowing.

None of my groaning aims to discredit any of that work. But there's still much more to do to flip around that bar graph I posted above, and that work includes passing Sen. Noel Frame's wealth tax, which could happen this year—if state lawmakers want it to. It also includes giving the Court an opportunity to right one of the biggest wrongs in this state by passing an income tax and having the justices revisit that dumb 1930s decision. Convincing lawmakers to do so will be a heavy lift, since polls and town halls show Washingtonians don't like the idea of an income tax, but Democrats should lend a hand rather than add more weight to the load.