One big shock in a moment that has many big shocks is the prediction that Jeff Bezos, the founder and CEO of the Seattle-based tentacular retail corporation, Amazon, will become a trillionaire by 2026. However, the method from which this projection results is deeply flawed.

Comparisun, the Tel Aviv-based "small business community & education platform" behind the viral post "The Trillion Dollar Club," did extrapolate from two reliable sources (one, data gathered by a Macrotrends, research platform for long term investors; and, two, the wealth rankings complied by Forbes). But it failed to include the pandemic in its trillionaire and other projections. (A note on Forbes' reliability is at the end of this post.)

This bizarre omission means Comparisun extrapolations can make some sense of the world before January 2020, but almost none of the one after that point of rupture.

For example, Comparisun predicts that the petroleum giants Royal Dutch Shell and Chevron will join the trillion-dollar club in 2039 and 2040, respectively. But the combination of the pandemic-triggered crash of oil prices and the long-term transformation of consumer habits under the new biological regime has made the future of Shell and Cheron virtually unknowable.

The same goes for Unitedhealth Group, which is predicted to reach that trillion by 2027. But the first significant COVID-19 job report revealed that the health sector is hemorrhaging jobs (1.4 million). As the business analyst Doug Hengwood put it: "...a bizarre development during a massive health crisis." I must also include the informational value of a Neko Case tweet storm that had the said for-profit health care company as its subject. There's no certainty at this time that the US's healthcare industry will survive the pandemic as is.

All that said, let's turn to the weakness of Comparisun's Amazon prediction. This corporation's commercial power was massively strengthened by the pandemic, which means Bezos could be a trillionaire within a much shorter period than the projected 6 years.

What will increase the speed of Bezos's progress to the first privately owned trillion is not only the novel social conditions imposed by the pandemic, but also, paradoxically, the re-opening of the economy in much of the middle of America.

More people in the U.S. are starting to move around, as state stay-at-home orders are eased.

About 25 million more people left their homes on an average day last week than during the preceding 6 weeks, a New York Times analysis of cellphone data found. https://t.co/AA0tlx3F2w

— The New York Times (@nytimes) May 13, 2020

I say paradoxically because it will not be the revival of business activity that'll benefit Amazon, but the complete opposite: the guaranteed economic disaster of premature opening. This fact was made clear by the National Institute of Allergy and Infectious Diseases director Dr. Anthony Fauci. Opening at this moment will do much more economic harm than good.

With that point in mind, we must add one made by another potential trillionaire, Bill Gates, in his ignored (at least by middle America) but important paper, "The First Modern Pandemic: The Scientific Advances We Need to Stop COVID-19." The plain fact is the economy closed itself without the government's help. And it will not just reopen because GOP and anti-lockdown white supremacists say it must.

Corroborating Gates's assertion is a recent data analysis of Florida conducted by the Tampa Bay Times. It found a pattern that robustly explains why the spread of the virus in the Sunshine State wasn't so devastating: people stayed at home before state officials told them to do so.

Tampa Bay Times

Why didn’t Florida see an explosion of cases?To answer that question, Tampa Bay Times reporters reviewed the methodology behind several prominent models and studied data tracing the virus’ spread into every corner of the state.

Then the Times analyzed cell phone tracking data collected by three companies that paints a vivid picture of how Floridians reacted during the outbreak’s early days. Fifteen experts reviewed the work and shared their observations.

The analysis indicates that while Florida’s politicians debated beach closings and stay-at-home orders, residents took matters into their own hands.

By the time each county shut down, there had been large reductions in activity, the cell phone data shows.

It is just not worth the trouble to go out and try to have fun if a fear of death throbs in the back your mind.

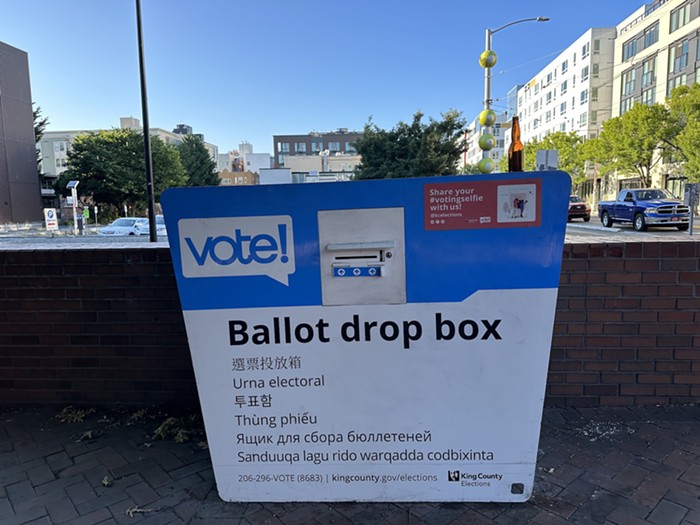

Putting all this together, we can make this prediction: The economies of re-opened states will suffer a serious economic re-collapse at around the time (July to August) presently closed states begin to reopen. The advantage these late states will have is improved management of the virus and carefully considered responses for resurgences. These states will constitute a huge economic block, such as California, Oregon, and Washington. The maintenance of their biological stability and economic recovery will necessarily require the increased surveillance of national and international movements at borders and airports.

So many innocent people are going to die because of Trump supporters in Wisconsin #RIPAmerica https://t.co/lKl8C2gSOw

— David Leavitt (@David_Leavitt) May 14, 2020

The implosion of the American heartland will force it into greater economic dependency on the late states, and this will only expand the wealth of the biggest stakeholder of Amazon, the post-pandemic corporation.

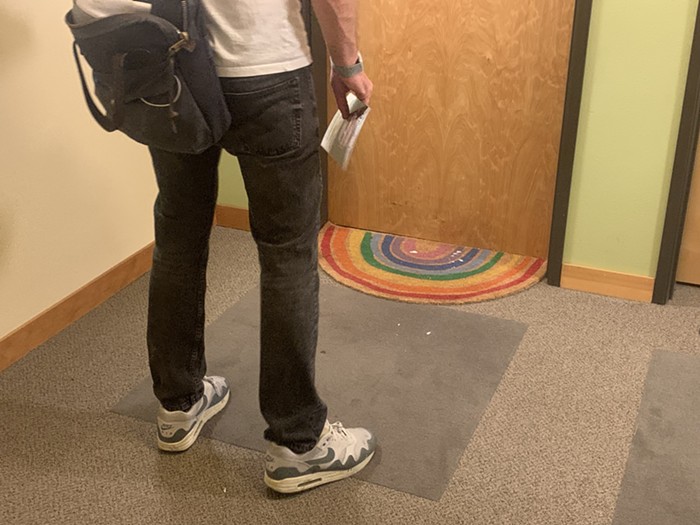

As for the left? Our problem is how to make the public's commitment to the uncomfortable custom of face masks and a prolonged lockdown pay for the poor, the working class, and the middle class—in short, work for democracy. The way things are heading—the resistance to fair taxes, the refusal to adequately protect renters and small to mid-sized mortgage holders from the economic impact of social distancing, and inaction on other progressive factors Cary Moon and I described in "What We Must Do To Remake the Post-Coronavirus City"—the rewards of the public's historically heroic effort will mostly end up in the bank accounts of the city's top earners.

In the emerging galaxy of the US's next economy, there will be five or six metros sucking into their depths vast amounts of money and value like black holes capturing and pulling into their singularities the matter of stars and planets. Seattle is already one of these black holes. And if the present configuration of capitalism continues, our city will become one of two or three super-massive black holes in these United States.

.

So many innocent people are going to die because of Trump supporters in Wisconsin #RIPAmerica https://t.co/lKl8C2gSOw

— David Leavitt (@David_Leavitt) May 14, 2020

Note on Forbes: Thomas Piketty used Forbes's wealth rankings in the most important economics book of the previous decade, Capital in 21st Century. And he did so despite knowing that "such rankings suffer from important biases and serious methodological problems (to put it mildly)." Flawed, yes; but also indispensable. Why? Because the rankings exist, and as such, as a thing in the world, they "respond to a legitimate and pressing social demand for information about a major issue of the day: the global distribution of wealth and its evolution over time." What this means is Forbes provides information about the structure/culture of social feeling, which, according to behavioural economics, is valid for determining the course of economic trends.